The Egyptian Tax Authority (ETA) is obligating 134 large businesses to submit electronic invoices to the online portal of ETA, as of 15 November 2020. ETA is responsible for the set-up and control of the Egypt electronic invoicing clearance system. It defines e-invoice as a digital document proving the transactions of sale of goods and provision of services.

The e-invoicing obligation will gradually extend to the other vatpayers after January 2021. It is part of the governments plan for full digitalization of its services.

Four main properties of e-invoices listed by ETA:

1) It has specific components and characteristics,

2) It is prepared and signed electronically,

3) Sent and received by the taxpayer through the system, and

4) Reviewed and verified by the tax authority

This means ETA will first validate and approve the supplier invoices before being sent to the customers.

How does the new e-invoicing system work?

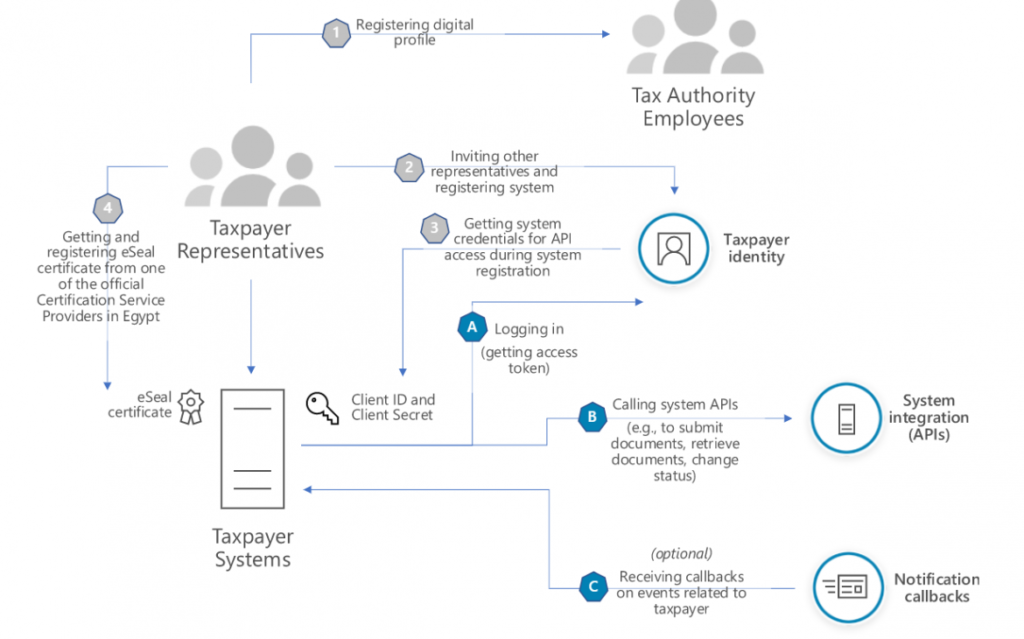

Companies compelled to use the e-invoicing system will be required to register to the system by contacting ETA. After successful registration, the client information will be provided to transmit invoices and receipts in XML or JSON data format. The system will allow the cancellation and rejection of invoices that have been issued incorrectly. Information such as the tax identification number, national ID number, name, and domicile of the vendor are required in the purchase invoice. VAT declaration will be automatically filled via invoices.

Each invoice is digitally signed by a HSM (hardware security model) device and receives a unique ID to ensure data security of the transactions between companies. Separate schemes exist for credit and debit notes. Credit and debit notes have to include a reference to the original document, by providing its unique ID.

For the products supplied, companies will have to use the GS1 coding system or an internal coding system linked to the Global Product Classification standards. The barcodes are used to provide standardized product coding for international business communication.

How can you handle the ERP integration process?

Egyptian tax authorities have published an overview of the steps in order to integrate the taxpayers ERP system to the e-invoicing system.

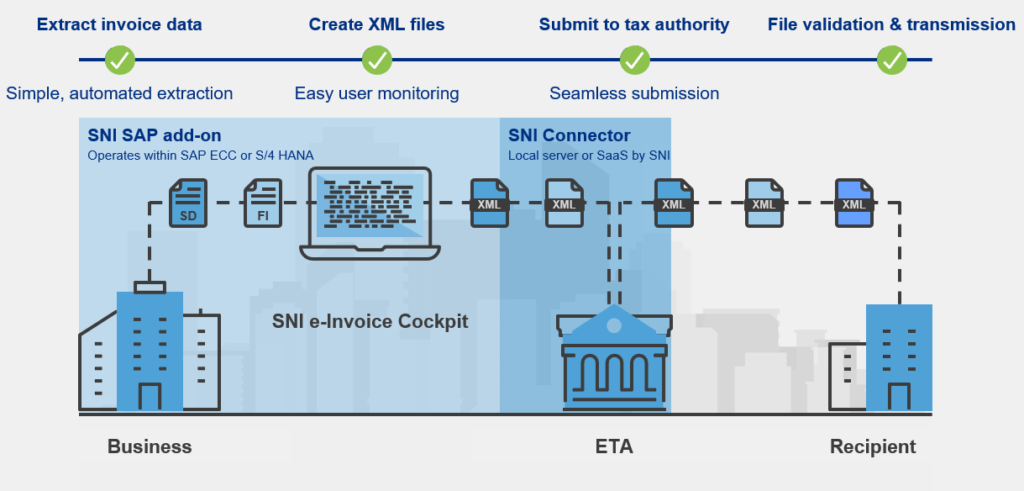

SNI Egypt e-Invoicing Solution Architecture